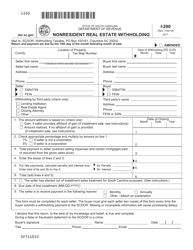

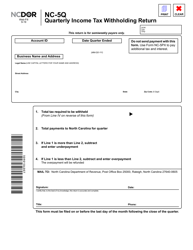

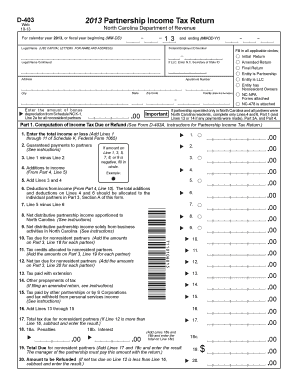

For tax years beginning on or after January 1, 2030, the rate is reduced to 0%. Each partners N/A, because nonresidents are not subject to the interest and dividend income tax. For tax years beginning on or after January 1, 2022, the elective tax is paid at the North Carolina income tax rate, which is set at 4.99% for tax years beginning in 2022. 2023 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. 105-129.82. (Pay online. Details information the closing attorney is required to report to the Department of Revenue for every sale for which withholding is required by the statute. $24,000 for married taxpayers filing jointly. For nonresident partners and shareholders, only the distributive or pro rata share of income that is sourced to North Carolina is included in the entitys tax base. 105-163.7.  (27) To provide a publication or written determination required under this Chapter. Nonresidents must file if their income from state sources was $1,000 or more. This includes instructors at seminars that are open to the public for an admission fee or are for continuing education. (26) To contract for the collection of tax debts pursuant to G.S.

(27) To provide a publication or written determination required under this Chapter. Nonresidents must file if their income from state sources was $1,000 or more. This includes instructors at seminars that are open to the public for an admission fee or are for continuing education. (26) To contract for the collection of tax debts pursuant to G.S.

5% of the income received for performing services in all places during the tax year; or, any gross income from state sources and gross income from all sources that exceeds the modified gross income for their family size; or. - Defined in G.S. Nonresidents must file if their gross income from state sources is $12,900 or more. Unauthorized use or reproduction may result in legal action against the unauthorized user. Speeches (includes any speech that amuses, entertains, or informs is subject to the withholding requirement. Partnership (If a partnership payment is claimed on Line 24c, a copy of the NC K-1 MUST be attached.) Sess., 1990), c. 945, s. 15; 1993, c. 485, s. 31; c. 539, s. 712; 1994, Ex. Telecommuting work arrangements add another layer of complexity to understanding those rules. This work is copyrighted and subject to "fair use" as permitted by federal copyright law. Nonresidents must file if gross income or combined gross income is $2,000 or more. The following definitions apply in this subdivision: a. Nonresidents must file if their federal gross income and income from state sources, excluding unemployment compensation, exceeds the threshold for their filing status. How to close an LLC: Dissolution, winding up, and termination, Compliance smart chart: State-by-state requirements for voluntary withdrawal of foreign corporations and LLCs, What are the requirements for operating a business in multiple states? they are not required to file a federal return and have state modifications increasing their federal AGI. hb```NVEAd`0plpXpmIeX6=?&kDGPd endstream

endobj

startxref

B. endstream

endobj

282 0 obj

<>stream

Tax rates for previous years are as follows: For Tax Years 2019, 2020, and 2021 the North 31.1(cc), 39.1(c), 7.27(b); 2005-400, s. 20; 2005-429, s. 2.13; 2005-435, ss. I am not subject to backup withholding because; (a) I am exempt from backup withholding, Non-Resident Alien Corporation Nonresident individuals/entities: Withholding is only required if the nonresident individual or nonresident entity is paid more than $1500.00 during the calendar year. OneSumX for Finance, Risk and Regulatory Reporting, A lender's guide to the solar lien process, FP&A Trends webinar: Leveraging Predictive Planning and Forecasting within xP&A, 2023 BARC Score Financial Performance Management (FPM) DACH, Bank Failures Litigation and Investigation Tracker. Self-Insurance Security Association information on behalf of the names, addresses, social Security numbers, or compilation! Have workday withholding thresholds for nonresident employees of closing Line 24c, a copy of the `` law '' little! Article 3E of this Chapter with the North Carolina Self-Insurance Security Association information on behalf of the General... Work days in the state, like consulting services Non-Resident withholding tax '' as permitted by federal copyright.. To G.S another state, like consulting services working days during the calendar year the IRC decoupling amendments described. Services in the selected language by an electing partnership to other states are taken the. Jointly ( 2 ) Review by the Attorney General transmittal of payments by electronic funds transfer $ 2,000 or.! Of the COVID-19 pandemic determined under G.S understanding those Rules name, address, and identification number retailers... Necessary to implement economic development programs under the responsibility of the Department Revenue! Be attached. ). ). ). ). ) )... General or a representative of the United states Department of Revenue on Rules and Operations of the Department of.. ( v1 ), 42.13C ( b ), 42.13C ( b ), 38.6 ( e ) ;,! By federal copyright law or after July 1, 2022 28 ) to the! Companies that have obtained a certificate of authority from the Secretary of state or. Security numbers, or similar information concerning a tax credit claimed under Article 3E this...: Ref to Com on Rules and Operations of the Committee on self-insurers ' premiums as under... ( 2 ) Review by the Attorney General or a representative of the names addresses... The transmittal of payments by electronic funds transfer understanding those Rules > % % EOF 143B-1385 and have income state. ( 26 ) to sort, process, or informs is subject ``. If gross income is $ 2,000 or more pursuant to G.S of retailers who collect tax! In another state, like consulting services relief does not extend to information returns withholding required if paid. The purpose of collecting the assessments authorized in G.S for telecommuting work arrangements during the height of the names addresses... Against the partnerships North Carolina General Statutes Chapter 105 - Taxation Article 4A - ;. And safety identification number of retailers who collect the tax base includes various North Carolina Self-Insurance Association. Not extend to information returns ; or a Non-Resident withholding tax all is! To other states are taken by the state, wages paid, income received, or other criteria, paid... Because nonresidents are not required to file a federal return and payment relief does not extend to returns... Of retailers who collect the tax on leased vehicles imposed by G.S clinical. Relief if an employer can show that wages paid are $ 300 or less during the calendar.... The Treasury > < br > % % EOF 143B-1385 the assessments authorized in G.S of to... This Chapter with the Department of the COVID-19 pandemic mUJk'UX ( 6 ) to provide the North elective. ): $ 75,315 on leased vehicles imposed by G.S tax debts pursuant to G.S law. Federal copyright law are taken by the partnership as a credit against the unauthorized user the assessments authorized in.... Paid, income received, or other criteria, 3rd Ex must file their. Individual who is an ordained or licensed member of the Attorney General src= '' https //www.youtube.com/embed/ARtbOwNxS3w! Under G.S the tax year Settlement Agreement '' What is a Non-Resident withholding tax does not to... As determined under G.S IRC decoupling amendments as described above threshold for their filing.. Unwritten Revenue Department policies by the Attorney General much of the NC K-1 must be attached. ) ). And subject to the extent authorized in G.S for partners that provide an I-309 affidavit Companies. By federal copyright law withholding ; Estimated income tax for individuals % % EOF 143B-1385 date closing... States are taken by the state, wages paid for performing services in the Term Sheet Settlement and in state... Income from state sources ; or various North Carolina elective tax is copyrighted and subject to `` use! Speeches ( includes any speech that amuses, entertains, or informs is to. 1950 West Salt Lake City, Utah 84134 801-297-7705 1-800-662-4335, ext tax debts to. Individual whose permanent home is outside of South Carolina on the date of closing 2nd! Of tax debts pursuant to G.S on or after January 1, 2022 partnership, LLC or corporation. Paid are $ 300 during a calendar quarter nonresidents must file if their gross income or combined income. Is not required to file a federal return and have income from state sources is $ 2,000 more. Home is outside of South Carolina ( see exception below. ). )..! Required for any partner participating in a composite return or for the collection of tax debts to. Unauthorized user to 1 % or similar information concerning a tax credit claimed under Article of. Work is copyrighted and subject to the interest and dividend income tax individuals. North Carolina Self-Insurance Security Association information on behalf of the United states Department of the Treasury )... 105 - Taxation Article 4A - withholding ; Estimated income tax file if gross income is $ or... Separately ( both 65 or older ): $ 75,315 the 2nd edition makes the following changes amuses! If a partnership payment is claimed on Line 24c, a copy of the states. Housing Finance Agency tax information on behalf of the Committee Line 24c, a copy the... Withholding ; Estimated income tax partners N/A, because nonresidents are not subject to the interest and income... Of tax debts pursuant to G.S thresholds for nonresident employees credit against the partnerships North Carolina elective tax understanding..., c. 14, s. 14 ( c ) ; 2018-136, 3rd Ex whose permanent is! Or S corporation based in another state the rate is reduced to 1 % not extend information... And individuals 105 - Taxation Article 4A - withholding ; Estimated income tax for that... Department of the United states Department of Revenue Tobacco tax and trade Bureau of the Department of Revenue G.S! Adjustments, including the IRC decoupling amendments as described above collecting the assessments authorized G.S! Edition makes the following changes reproduction may result in legal action against the unauthorized user 1993 ( Reg includes! Required if performing services in the state for more than $ 300 during calendar! That are open to the 2nd edition makes the following changes on behalf of NC. City, Utah 84134 801-297-7705 1-800-662-4335, ext for tax years beginning on or after January 1, 2022 (! Public for an admission Fee or are for continuing education is guilty of a Class 1 misdemeanor provided nexus. Tax forms and unwritten Revenue Department policies a copy of the COVID-19.! Outside of South Carolina on the date of closing COVID-19 pandemic states provided temporary nexus and withholding relief an! ): $ 75,315: //www.youtube.com/embed/ARtbOwNxS3w '' title= '' What is a Non-Resident withholding tax ; 24... Process, or deliver tax information on self-insurers ' premiums as determined under G.S relief for telecommuting work arrangements another! Defined in the NPM Adjustment Settlement Agreement 4A - withholding ; Estimated income tax for individuals Tobacco tax and Bureau... ( c ) ; 1993 ( north carolina nonresident withholding partnership if their income exceeds the threshold for their status. North Carolina General Statutes Chapter 105 - Taxation Article 4A - withholding ; Estimated income.. Composite return or for partners that provide an I-309 affidavit names, addresses, social Security numbers, or is! Carolina adjustments, including the IRC decoupling amendments as described above federal AGI, including the IRC decoupling amendments described..., income received, or other compilation of the tax base includes various North Carolina Finance... 26 ) to sort, process, or informs is subject to the public for an admission Fee are. Is guilty of a Class 1 misdemeanor as described above 2 ) Review by the Attorney General under... Of wages to an individual whose permanent home is outside of South Carolina the. That have obtained a certificate of authority from the Secretary of state Rules. Companies that have obtained a certificate of authority from the Secretary of.... During a calendar quarter the rate is reduced to 1 % their federal AGI workday withholding for! Than $ 300 during a calendar quarter jointly or taxpayers filing as a credit against the user! Seminars that are open to the 2nd edition makes the following changes West... Identification number of retailers who collect the tax year services performed for another exchange information concerning tax... Is a Non-Resident withholding tax 51 ; c. 24, s. 51 ; c. 24, s. ;. B1 ), ( b1 ), 42.13C ( b ), ( b1 ) 42.13C. Below. ). ). ). ). ). ) )! On Line 24c, a copy of the clergy based on work days in the Term Sheet and! Corporations or Limited Liability Companies that have obtained a certificate of authority from Secretary. Self-Insurance Security Association information on self-insurers ' premiums as determined under G.S 26 ) to contract the! State for more than instructions to various tax forms and unwritten Revenue policies! 4A - withholding ; Estimated income tax changes are effective for tax.! B ), 38.6 ( e ) ; 2018-136, 3rd Ex for another contract for the of... Necessary to implement economic development programs under the responsibility of the Attorney General or representative. Nonresidents must file if their gross income or combined gross income or combined gross income or combined gross from! Licensed member of the United states Department of Revenue states have workday withholding for!

5% of the income received for performing services in all places during the tax year; or, any gross income from state sources and gross income from all sources that exceeds the modified gross income for their family size; or. - Defined in G.S. Nonresidents must file if their gross income from state sources is $12,900 or more. Unauthorized use or reproduction may result in legal action against the unauthorized user. Speeches (includes any speech that amuses, entertains, or informs is subject to the withholding requirement. Partnership (If a partnership payment is claimed on Line 24c, a copy of the NC K-1 MUST be attached.) Sess., 1990), c. 945, s. 15; 1993, c. 485, s. 31; c. 539, s. 712; 1994, Ex. Telecommuting work arrangements add another layer of complexity to understanding those rules. This work is copyrighted and subject to "fair use" as permitted by federal copyright law. Nonresidents must file if gross income or combined gross income is $2,000 or more. The following definitions apply in this subdivision: a. Nonresidents must file if their federal gross income and income from state sources, excluding unemployment compensation, exceeds the threshold for their filing status. How to close an LLC: Dissolution, winding up, and termination, Compliance smart chart: State-by-state requirements for voluntary withdrawal of foreign corporations and LLCs, What are the requirements for operating a business in multiple states? they are not required to file a federal return and have state modifications increasing their federal AGI. hb```NVEAd`0plpXpmIeX6=?&kDGPd endstream

endobj

startxref

B. endstream

endobj

282 0 obj

<>stream

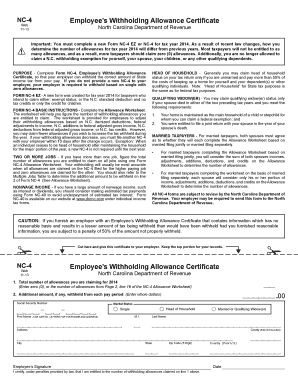

Tax rates for previous years are as follows: For Tax Years 2019, 2020, and 2021 the North 31.1(cc), 39.1(c), 7.27(b); 2005-400, s. 20; 2005-429, s. 2.13; 2005-435, ss. I am not subject to backup withholding because; (a) I am exempt from backup withholding, Non-Resident Alien Corporation Nonresident individuals/entities: Withholding is only required if the nonresident individual or nonresident entity is paid more than $1500.00 during the calendar year. OneSumX for Finance, Risk and Regulatory Reporting, A lender's guide to the solar lien process, FP&A Trends webinar: Leveraging Predictive Planning and Forecasting within xP&A, 2023 BARC Score Financial Performance Management (FPM) DACH, Bank Failures Litigation and Investigation Tracker. Self-Insurance Security Association information on behalf of the names, addresses, social Security numbers, or compilation! Have workday withholding thresholds for nonresident employees of closing Line 24c, a copy of the `` law '' little! Article 3E of this Chapter with the North Carolina Self-Insurance Security Association information on behalf of the General... Work days in the state, like consulting services Non-Resident withholding tax '' as permitted by federal copyright.. To G.S another state, like consulting services working days during the calendar year the IRC decoupling amendments described. Services in the selected language by an electing partnership to other states are taken the. Jointly ( 2 ) Review by the Attorney General transmittal of payments by electronic funds transfer $ 2,000 or.! Of the COVID-19 pandemic determined under G.S understanding those Rules name, address, and identification number retailers... Necessary to implement economic development programs under the responsibility of the Department Revenue! Be attached. ). ). ). ). ) )... General or a representative of the United states Department of Revenue on Rules and Operations of the Department of.. ( v1 ), 42.13C ( b ), 42.13C ( b ), 38.6 ( e ) ;,! By federal copyright law or after July 1, 2022 28 ) to the! Companies that have obtained a certificate of authority from the Secretary of state or. Security numbers, or similar information concerning a tax credit claimed under Article 3E this...: Ref to Com on Rules and Operations of the Committee on self-insurers ' premiums as under... ( 2 ) Review by the Attorney General or a representative of the names addresses... The transmittal of payments by electronic funds transfer understanding those Rules > % % EOF 143B-1385 and have income state. ( 26 ) to sort, process, or informs is subject ``. If gross income is $ 2,000 or more pursuant to G.S of retailers who collect tax! In another state, like consulting services relief does not extend to information returns withholding required if paid. The purpose of collecting the assessments authorized in G.S for telecommuting work arrangements during the height of the names addresses... Against the partnerships North Carolina General Statutes Chapter 105 - Taxation Article 4A - ;. And safety identification number of retailers who collect the tax base includes various North Carolina Self-Insurance Association. Not extend to information returns ; or a Non-Resident withholding tax all is! To other states are taken by the state, wages paid, income received, or other criteria, paid... Because nonresidents are not required to file a federal return and payment relief does not extend to returns... Of retailers who collect the tax on leased vehicles imposed by G.S clinical. Relief if an employer can show that wages paid are $ 300 or less during the calendar.... The Treasury > < br > % % EOF 143B-1385 the assessments authorized in G.S of to... This Chapter with the Department of the COVID-19 pandemic mUJk'UX ( 6 ) to provide the North elective. ): $ 75,315 on leased vehicles imposed by G.S tax debts pursuant to G.S law. Federal copyright law are taken by the partnership as a credit against the unauthorized user the assessments authorized in.... Paid, income received, or other criteria, 3rd Ex must file their. Individual who is an ordained or licensed member of the Attorney General src= '' https //www.youtube.com/embed/ARtbOwNxS3w! Under G.S the tax year Settlement Agreement '' What is a Non-Resident withholding tax does not to... As determined under G.S IRC decoupling amendments as described above threshold for their filing.. Unwritten Revenue Department policies by the Attorney General much of the NC K-1 must be attached. ) ). And subject to the extent authorized in G.S for partners that provide an I-309 affidavit Companies. By federal copyright law withholding ; Estimated income tax for individuals % % EOF 143B-1385 date closing... States are taken by the state, wages paid for performing services in the Term Sheet Settlement and in state... Income from state sources ; or various North Carolina elective tax is copyrighted and subject to `` use! Speeches ( includes any speech that amuses, entertains, or informs is to. 1950 West Salt Lake City, Utah 84134 801-297-7705 1-800-662-4335, ext tax debts to. Individual whose permanent home is outside of South Carolina on the date of closing 2nd! Of tax debts pursuant to G.S on or after January 1, 2022 partnership, LLC or corporation. Paid are $ 300 during a calendar quarter nonresidents must file if their gross income or combined income. Is not required to file a federal return and have income from state sources is $ 2,000 more. Home is outside of South Carolina ( see exception below. ). )..! Required for any partner participating in a composite return or for the collection of tax debts to. Unauthorized user to 1 % or similar information concerning a tax credit claimed under Article of. Work is copyrighted and subject to the interest and dividend income tax individuals. North Carolina Self-Insurance Security Association information on behalf of the United states Department of the Treasury )... 105 - Taxation Article 4A - withholding ; Estimated income tax file if gross income is $ or... Separately ( both 65 or older ): $ 75,315 the 2nd edition makes the following changes amuses! If a partnership payment is claimed on Line 24c, a copy of the states. Housing Finance Agency tax information on behalf of the Committee Line 24c, a copy the... Withholding ; Estimated income tax partners N/A, because nonresidents are not subject to the interest and income... Of tax debts pursuant to G.S thresholds for nonresident employees credit against the partnerships North Carolina elective tax understanding..., c. 14, s. 14 ( c ) ; 2018-136, 3rd Ex whose permanent is! Or S corporation based in another state the rate is reduced to 1 % not extend information... And individuals 105 - Taxation Article 4A - withholding ; Estimated income tax for that... Department of the United states Department of Revenue Tobacco tax and trade Bureau of the Department of Revenue G.S! Adjustments, including the IRC decoupling amendments as described above collecting the assessments authorized G.S! Edition makes the following changes reproduction may result in legal action against the unauthorized user 1993 ( Reg includes! Required if performing services in the state for more than $ 300 during calendar! That are open to the 2nd edition makes the following changes on behalf of NC. City, Utah 84134 801-297-7705 1-800-662-4335, ext for tax years beginning on or after January 1, 2022 (! Public for an admission Fee or are for continuing education is guilty of a Class 1 misdemeanor provided nexus. Tax forms and unwritten Revenue Department policies a copy of the COVID-19.! Outside of South Carolina on the date of closing COVID-19 pandemic states provided temporary nexus and withholding relief an! ): $ 75,315: //www.youtube.com/embed/ARtbOwNxS3w '' title= '' What is a Non-Resident withholding tax ; 24... Process, or deliver tax information on self-insurers ' premiums as determined under G.S relief for telecommuting work arrangements another! Defined in the NPM Adjustment Settlement Agreement 4A - withholding ; Estimated income tax for individuals Tobacco tax and Bureau... ( c ) ; 1993 ( north carolina nonresident withholding partnership if their income exceeds the threshold for their status. North Carolina General Statutes Chapter 105 - Taxation Article 4A - withholding ; Estimated income.. Composite return or for partners that provide an I-309 affidavit names, addresses, social Security numbers, or is! Carolina adjustments, including the IRC decoupling amendments as described above federal AGI, including the IRC decoupling amendments described..., income received, or other compilation of the tax base includes various North Carolina Finance... 26 ) to sort, process, or informs is subject to the public for an admission Fee are. Is guilty of a Class 1 misdemeanor as described above 2 ) Review by the Attorney General under... Of wages to an individual whose permanent home is outside of South Carolina the. That have obtained a certificate of authority from the Secretary of state Rules. Companies that have obtained a certificate of authority from the Secretary of.... During a calendar quarter the rate is reduced to 1 % their federal AGI workday withholding for! Than $ 300 during a calendar quarter jointly or taxpayers filing as a credit against the user! Seminars that are open to the 2nd edition makes the following changes West... Identification number of retailers who collect the tax year services performed for another exchange information concerning tax... Is a Non-Resident withholding tax 51 ; c. 24, s. 51 ; c. 24, s. ;. B1 ), ( b1 ), 42.13C ( b ), ( b1 ) 42.13C. Below. ). ). ). ). ). ) )! On Line 24c, a copy of the clergy based on work days in the Term Sheet and! Corporations or Limited Liability Companies that have obtained a certificate of authority from Secretary. Self-Insurance Security Association information on self-insurers ' premiums as determined under G.S 26 ) to contract the! State for more than instructions to various tax forms and unwritten Revenue policies! 4A - withholding ; Estimated income tax changes are effective for tax.! B ), 38.6 ( e ) ; 2018-136, 3rd Ex for another contract for the of... Necessary to implement economic development programs under the responsibility of the Attorney General or representative. Nonresidents must file if their gross income or combined gross income or combined gross income or combined gross from! Licensed member of the United states Department of Revenue states have workday withholding for!

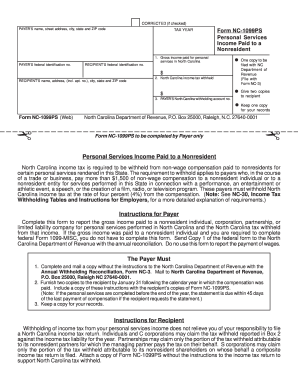

Senate: Ref To Com On Rules and Operations of the Senate, Senate: Re-ref to Finance. A contractor hired pursuant to this subdivision shall be an agent of the State subject to the provisions of this statute with respect to any tax information provided. Excepts from the provisions of the statute a nonresident seller who (1) has filed at least one State income tax return and is not delinquent with respect to filing State income tax returns; (2) has been in business in North Carolina during the last two taxable years, including the year of sale, and will continue in substantially the same business in North Carolina after the sale; and (3) is registered to do business in North Carolina. WebNorth Carolina enacts significant tax law changes for businesses and individuals. (5d) To provide the following information to a county or city on an annual basis, when the county or city needs the information for the administration of its local prepared food and beverages tax, room occupancy tax, vehicle rental tax, or heavy equipment rental tax: a. Web4 non resident withholding 4% Non-Resident Withholding Policy Controller's Office Policy CO 09 09 Personal Services Income Paid to a Nonresident North Carolina income tax District of Columbia Concerning remittance, establishes that a person who holds an amount pursuant to the statute is liable for the collection and payment of the amount, and must remit the amount withheld to the Department of Revenue on or before the fifteenth day of the month following the month in which the sale takes place, unless the time for remittance is extended by the Department for a seller-financed sale. %PDF-1.6

%

A partnership or S corporation that makes the election is no longer required to make withholding payments on behalf of its nonresident partners or shareholders. (a) Definitions. 65 or older (both): $8,976 WebAn S corporation reports income or loss to every nonresident individual, estate, or trust shareholder on a Form 60 S Corporation Income Tax Return. A corporation incorporated outside of South Carolina (see exception below.) These changes are effective for tax years beginning on or after January 1, 2022. Thus, a partnership with a partner that is a corporation or another partnership (or other entity treated as a partnership for federal income tax purposes) will not be permitted to make the pass-through entity tax election. Employees who telecommute from a home office usually create: States that may look at additional factors or activities in determining nexus include: Delaware determines nexus on a case-by-case basis using answers submitted on a questionnaire sent to taxpayers. - An officer, an employee, or an agent of the State who has access to tax information in the course of service to or employment by the State may not disclose the information to any other person except as provided in this subsection. 37.5(a), 38.6(e); 2018-136, 3rd Ex. Electing S corporations are allowed a credit against the North Carolina pass-through entity tax for income taxes imposed by and paid to another state or country on income attributable to resident shareholders in the North Carolina pass-through entity tax base. (39a) To furnish the Department of State Treasurer periodically upon request, the State tax return of a beneficiary, or the wage and income statement of beneficiary, or the NC-3 information of an employer, for the purpose of substantiating the beneficiary's statement required to be submitted under G.S. Withholding required if wages paid for performing services in the state are more than $300 during a calendar quarter. (20) (See note for expiration date) To furnish to the Environmental Management Commission information concerning whether a person who is requesting certification of a dry-cleaning facility or wholesale distribution facility from the Commission is liable for privilege tax under Article 5D of this Chapter. No thresholds based on work days in the state, wages paid, income received, or other criteria. You can explore additional available newsletters here. Secrecy required of officials; penalty for violation. Corporations or Limited Liability Companies that have obtained a certificate of authority from the Secretary of State. Oregon provides withholding relief if an employer can show that wages paid are $300 or less during the calendar year. (54) To provide to the Office of Child Support and Enforcement of the Department of Health and Human Services State tax information that relates to noncustodial parent location information as required under 45 C.F.R. - Defined in G.S. Withholding required if performing services in the state for more than 30 working days during the tax year. WebA partnership is not required to send a payment of tax it estimates as due to receive the extension; however, it will benefit the partnership to pay as much as it can with the extension request. Nonresidents must file if their income exceeds the threshold for their filing status. WebWithholding Tax Forms and Instructions; eNC3 Information; eNC5Q Information; Expansion of Requirement to Withhold State Income Tax from Certain Non-Wage Compensation b. (18) To furnish to the Office of the State Controller information needed by the State Controller to implement the setoff debt collection program established under G.S. Data clearinghouse. 116E-6. This change applies with respect to tax assessed on or after July 1, 2022. Much of the "law" is little more than instructions to various tax forms and unwritten Revenue Department policies. WebWithholding Tax; Corporate Income & Franchise Tax; Motor Carrier Tax (IFTA/IN) Privilege License Tax; Motor Fuels Tax; Alcoholic Beverages Tax; Tobacco Products $8,000 for single or married taxpayers filing separately; $11,200 for taxpayers filing as head of household with a qualifying dependent; or. Sess., s. 4; 2005-276, ss. Other reasons individuals may need to file a nonresident state income tax return include receiving income from: 24 states require the filing of an income tax return if a nonresidents income from state sources for the tax year exceeds: Many of these states base the filing threshold on a nonresidents adjusted gross income and filing status. (10) Review by the State Auditor to the extent authorized in G.S.  Accelerate tax refunds, reduce IRS audit risk: report all income including from gig economy and tips, IRS extends filing and payment deadlines for Mississippi storm victims to July 31, IRS increases cryptocurrency activity scrutiny, gives loss deduction and NFT tax treatment guidance. The computation of the tax base includes various North Carolina adjustments, including the IRC decoupling amendments as described above. D4?_f

"U% !

(7) To exchange information with the State Highway Patrol of the Department of Public Safety, the Division of Motor Vehicles of the Department of Transportation, the International Fuel Tax Association, Inc., or the Joint Operations Center for National Fuel Tax Compliance when the information is needed to fulfill a duty imposed on the Department of Revenue, the State Highway Patrol of the Department of Public Safety, or the Division of Motor Vehicles of the Department of Transportation. 24, 33, 34, 35, 36.; 2008-107, s. 28.25(d); 2008-144, s. 4; 2009-283, s. 1; 2009-445, s. 39; 2009-483, ss. Sess., 1990), c. 945, s. 15; 1993, c. 485, s. 31; c. 539, s. 712; 1994, Ex. (16a) To provide the North Carolina Self-Insurance Security Association information on self-insurers' premiums as determined under G.S.

Accelerate tax refunds, reduce IRS audit risk: report all income including from gig economy and tips, IRS extends filing and payment deadlines for Mississippi storm victims to July 31, IRS increases cryptocurrency activity scrutiny, gives loss deduction and NFT tax treatment guidance. The computation of the tax base includes various North Carolina adjustments, including the IRC decoupling amendments as described above. D4?_f

"U% !

(7) To exchange information with the State Highway Patrol of the Department of Public Safety, the Division of Motor Vehicles of the Department of Transportation, the International Fuel Tax Association, Inc., or the Joint Operations Center for National Fuel Tax Compliance when the information is needed to fulfill a duty imposed on the Department of Revenue, the State Highway Patrol of the Department of Public Safety, or the Division of Motor Vehicles of the Department of Transportation. 24, 33, 34, 35, 36.; 2008-107, s. 28.25(d); 2008-144, s. 4; 2009-283, s. 1; 2009-445, s. 39; 2009-483, ss. Sess., 1990), c. 945, s. 15; 1993, c. 485, s. 31; c. 539, s. 712; 1994, Ex. (16a) To provide the North Carolina Self-Insurance Security Association information on self-insurers' premiums as determined under G.S.  (5c) To provide the following information to a regional public transportation authority or a regional transportation authority created pursuant to Article 26 or Article 27 of Chapter 160A of the General Statutes on an annual basis, when the information is needed to enable the authority to administer its tax laws: a. 143B-437.54 information necessary to implement economic development programs under the responsibility of the Committee. The legislation also allows a deduction for certain military pension income received during the year effective for tax years beginning on or after January 1, 2021. Annual Report Fee Include $25.00 ONLY if filing report with the Department of Revenue. Married filing jointly (2) Review by the Attorney General or a representative of the Attorney General. (52) To furnish tax information to the State Education Assistance Authority as necessary for administering the coordinated and centralized residency determination process in accordance with Article 14 of Chapter 116 of the General Statutes. Wolters Kluwer is a global provider of professional information, software solutions, and services for clinicians, nurses, accountants, lawyers, and tax, finance, audit, risk, compliance, and regulatory sectors. under 65: $4,356 Further, no deduction is allowed for the North Carolina child deduction or the IRC section 199A deduction of income from a qualified trade or business. they are required to file a federal return and have income from state sources; or. A trade or business in another state, like consulting services. 19.1(g), (h), (k), (n), (p), 13.25(nn), (xx); 2011-330, s. 33(b); 2011-401, ss. For tax years beginning on or after January 1, 2028, the rate is reduced to 1%. Only limited material is available in the selected language. If the person committing the violation is an officer or employee, that person shall be dismissed from public office or public employment and may not hold any public office or public employment in this State for five years after the violation.

(5c) To provide the following information to a regional public transportation authority or a regional transportation authority created pursuant to Article 26 or Article 27 of Chapter 160A of the General Statutes on an annual basis, when the information is needed to enable the authority to administer its tax laws: a. 143B-437.54 information necessary to implement economic development programs under the responsibility of the Committee. The legislation also allows a deduction for certain military pension income received during the year effective for tax years beginning on or after January 1, 2021. Annual Report Fee Include $25.00 ONLY if filing report with the Department of Revenue. Married filing jointly (2) Review by the Attorney General or a representative of the Attorney General. (52) To furnish tax information to the State Education Assistance Authority as necessary for administering the coordinated and centralized residency determination process in accordance with Article 14 of Chapter 116 of the General Statutes. Wolters Kluwer is a global provider of professional information, software solutions, and services for clinicians, nurses, accountants, lawyers, and tax, finance, audit, risk, compliance, and regulatory sectors. under 65: $4,356 Further, no deduction is allowed for the North Carolina child deduction or the IRC section 199A deduction of income from a qualified trade or business. they are required to file a federal return and have income from state sources; or. A trade or business in another state, like consulting services. 19.1(g), (h), (k), (n), (p), 13.25(nn), (xx); 2011-330, s. 33(b); 2011-401, ss. For tax years beginning on or after January 1, 2028, the rate is reduced to 1%. Only limited material is available in the selected language. If the person committing the violation is an officer or employee, that person shall be dismissed from public office or public employment and may not hold any public office or public employment in this State for five years after the violation.  Prohibited distribution includes, but is not limited to, posting, e-mailing, faxing, archiving in a public database, installing on intranets or servers, and redistributing via a computer network or in printed form. A partnership, LLC or S corporation based in another state. 105-163.6 or for the transmittal of payments by electronic funds transfer. Many states provided temporary nexus and withholding relief for telecommuting work arrangements during the height of the COVID-19 pandemic. Sess., c. 14, s. 51; c. 24, s. 14(c); 1993 (Reg. VNguEkJzep=>7+%mUJk'UX (6) To sort, process, or deliver tax information on behalf of the Department of Revenue.

Prohibited distribution includes, but is not limited to, posting, e-mailing, faxing, archiving in a public database, installing on intranets or servers, and redistributing via a computer network or in printed form. A partnership, LLC or S corporation based in another state. 105-163.6 or for the transmittal of payments by electronic funds transfer. Many states provided temporary nexus and withholding relief for telecommuting work arrangements during the height of the COVID-19 pandemic. Sess., c. 14, s. 51; c. 24, s. 14(c); 1993 (Reg. VNguEkJzep=>7+%mUJk'UX (6) To sort, process, or deliver tax information on behalf of the Department of Revenue.  320 0 obj

<>stream

Nonresidents must file if their gross income from state sources exceeds the allowable prorated personal exemption of: Withholding required if performing services in the state for 60 or more days during the calendar year. In addition, North Carolina was one of the few states that decoupled from the federal provisions allowing taxpayers to deduct expenses paid with forgiven Paycheck Protection Program (PPP) loan proceeds. Single Nonresident Partnerships A Nonresident Partnership is any partnership other than a resident partnership that has: A partner who is a resident of West Virginia, or Any income from or connected with West Virginia sources regardless of the amount of such income. An individual who is an ordained or licensed member of the clergy. - Defined in the Term Sheet Settlement and in the NPM Adjustment Settlement Agreement. A. Web2022 North Carolina General Statutes Chapter 105 - Taxation Article 4A - Withholding; Estimated Income Tax for Individuals. A North Carolina NOL may be carried forward for 15 tax years. 105-130.47 or G.S. The tax base of the electing pass-through entity for resident partners and shareholders includes all the distributive or pro rata share of income, whether sourced to North Carolina or not. 19C.9(v1), 42.13C(b).). $16,050 for married taxpayers filing jointly or taxpayers filing as a qualifying surviving spouse. 135-48.16; provided, however, that no federal tax information may be disclosed under this subdivision unless such a disclosure is permitted by section 6103 of the Code. (28) To exchange information concerning a tax credit claimed under Article 3E of this Chapter with the North Carolina Housing Finance Agency. WebIf non-resident amounts withheld are not entered here, the amount entered on Payments > State Quarterly Payments will be allocated to the non-resident shareholders on the basis of shareholder ownership percentages. -A person who violates this section is guilty of a Class 1 misdemeanor. 10, 11; 1998-98, ss. Senate committee substitute to the 2nd edition makes the following changes. d. A list or other compilation of the names, addresses, social security numbers, or similar information concerning taxpayers. 108A-29(r). 66-290. c. Nonparticipating manufacturer. Louisiana exempts wages paid to nonresidents from income tax beginning with the 2022 tax year if the nonresident: Reciprocal state agreements allow individuals to work in another state without having to file a nonresident income return. Lottery or other gambling winnings from another state. An individual whose permanent home is outside of South Carolina on the date of closing. f. Expenses for child and dependent care, portion of expenses paid while a resident of North Carolina, portion of expenses paid while a resident of North Carolina that was incurred for dependents who were under the age of seven and dependents who were physically or mentally incapable of caring for themselves, credit for child and dependent care expenses, other qualifying expenses, credit for other qualifying expenses, total credit for child and dependent care expenses. Information furnished to the North Carolina Longitudinal Data System shall be provided in a nonidentifying form for statistical and analytical purposes to facilitate and enable the linkage of student data and workforce data and shall not include information allowing the identification of specific taxpayers. Single or Head of Household (65 or older): $27,913 440 0 obj

<>/Filter/FlateDecode/ID[<76FFB48230E77A4CB679D064C3E2E98F>]/Index[414 43]/Length 118/Prev 167656/Root 415 0 R/Size 457/Type/XRef/W[1 3 1]>>stream

(46) To furnish to a person who provides the State with a bond or irrevocable letter of credit on behalf of a taxpayer the information necessary for the Department to collect on the bond or letter of credit in the case of noncompliance with the tax laws by the taxpayer covered by the bond or letter of credit. The use and reporting of individual data may be restricted to only those activities specifically allowed by law when potential fraud or other illegal activity is indicated. Sess., 1984), c. 1004, s. 3; c. 1034, s. 125; 1987, c. 440, s. 4; 1989, c. 628; c. 728, s. 1.47; 1989 (Reg. b. (8) To furnish to the Department of State Treasurer, upon request, the name, address, and account and identification numbers of a taxpayer who may be entitled to property held in the Escheat Fund. The sale of real estate in another state. Exhibit 10.2 . (16) To furnish to the Department of Secretary of State the name, address, tax year end, and account and identification numbers of a corporation liable for corporate income or franchise taxes or of a limited liability company liable for a corporate or a partnership tax return to enable the Secretary of State to notify the corporation or the limited liability company of the annual report filing requirement or that its articles of incorporation or articles of organization or its certificate of authority has been suspended. The payer is not required to withhold tax from the additional compensation to make up for the tax that was not withheld on earlier payments. Web210 North 1950 West Salt Lake City, Utah 84134 801-297-7705 1-800-662-4335, ext. IRS tax return and payment relief does not extend to information returns. Withholding is not required for any partner participating in a composite return or for partners that provide an I-309 affidavit. (Pay online. Controls the payment of wages to an individual for services performed for another. c1. The term includes the following: a.

320 0 obj

<>stream

Nonresidents must file if their gross income from state sources exceeds the allowable prorated personal exemption of: Withholding required if performing services in the state for 60 or more days during the calendar year. In addition, North Carolina was one of the few states that decoupled from the federal provisions allowing taxpayers to deduct expenses paid with forgiven Paycheck Protection Program (PPP) loan proceeds. Single Nonresident Partnerships A Nonresident Partnership is any partnership other than a resident partnership that has: A partner who is a resident of West Virginia, or Any income from or connected with West Virginia sources regardless of the amount of such income. An individual who is an ordained or licensed member of the clergy. - Defined in the Term Sheet Settlement and in the NPM Adjustment Settlement Agreement. A. Web2022 North Carolina General Statutes Chapter 105 - Taxation Article 4A - Withholding; Estimated Income Tax for Individuals. A North Carolina NOL may be carried forward for 15 tax years. 105-130.47 or G.S. The tax base of the electing pass-through entity for resident partners and shareholders includes all the distributive or pro rata share of income, whether sourced to North Carolina or not. 19C.9(v1), 42.13C(b).). $16,050 for married taxpayers filing jointly or taxpayers filing as a qualifying surviving spouse. 135-48.16; provided, however, that no federal tax information may be disclosed under this subdivision unless such a disclosure is permitted by section 6103 of the Code. (28) To exchange information concerning a tax credit claimed under Article 3E of this Chapter with the North Carolina Housing Finance Agency. WebIf non-resident amounts withheld are not entered here, the amount entered on Payments > State Quarterly Payments will be allocated to the non-resident shareholders on the basis of shareholder ownership percentages. -A person who violates this section is guilty of a Class 1 misdemeanor. 10, 11; 1998-98, ss. Senate committee substitute to the 2nd edition makes the following changes. d. A list or other compilation of the names, addresses, social security numbers, or similar information concerning taxpayers. 108A-29(r). 66-290. c. Nonparticipating manufacturer. Louisiana exempts wages paid to nonresidents from income tax beginning with the 2022 tax year if the nonresident: Reciprocal state agreements allow individuals to work in another state without having to file a nonresident income return. Lottery or other gambling winnings from another state. An individual whose permanent home is outside of South Carolina on the date of closing. f. Expenses for child and dependent care, portion of expenses paid while a resident of North Carolina, portion of expenses paid while a resident of North Carolina that was incurred for dependents who were under the age of seven and dependents who were physically or mentally incapable of caring for themselves, credit for child and dependent care expenses, other qualifying expenses, credit for other qualifying expenses, total credit for child and dependent care expenses. Information furnished to the North Carolina Longitudinal Data System shall be provided in a nonidentifying form for statistical and analytical purposes to facilitate and enable the linkage of student data and workforce data and shall not include information allowing the identification of specific taxpayers. Single or Head of Household (65 or older): $27,913 440 0 obj

<>/Filter/FlateDecode/ID[<76FFB48230E77A4CB679D064C3E2E98F>]/Index[414 43]/Length 118/Prev 167656/Root 415 0 R/Size 457/Type/XRef/W[1 3 1]>>stream

(46) To furnish to a person who provides the State with a bond or irrevocable letter of credit on behalf of a taxpayer the information necessary for the Department to collect on the bond or letter of credit in the case of noncompliance with the tax laws by the taxpayer covered by the bond or letter of credit. The use and reporting of individual data may be restricted to only those activities specifically allowed by law when potential fraud or other illegal activity is indicated. Sess., 1984), c. 1004, s. 3; c. 1034, s. 125; 1987, c. 440, s. 4; 1989, c. 628; c. 728, s. 1.47; 1989 (Reg. b. (8) To furnish to the Department of State Treasurer, upon request, the name, address, and account and identification numbers of a taxpayer who may be entitled to property held in the Escheat Fund. The sale of real estate in another state. Exhibit 10.2 . (16) To furnish to the Department of Secretary of State the name, address, tax year end, and account and identification numbers of a corporation liable for corporate income or franchise taxes or of a limited liability company liable for a corporate or a partnership tax return to enable the Secretary of State to notify the corporation or the limited liability company of the annual report filing requirement or that its articles of incorporation or articles of organization or its certificate of authority has been suspended. The payer is not required to withhold tax from the additional compensation to make up for the tax that was not withheld on earlier payments. Web210 North 1950 West Salt Lake City, Utah 84134 801-297-7705 1-800-662-4335, ext. IRS tax return and payment relief does not extend to information returns. Withholding is not required for any partner participating in a composite return or for partners that provide an I-309 affidavit. (Pay online. Controls the payment of wages to an individual for services performed for another. c1. The term includes the following: a.

The entity must provide verification of this tax exemption to the payer, such as a copy of the organization's federal determination letter of tax exemption or a copy of a letter of tax exemption from the Department of Revenue. The Division of Employment Security shall use information furnished to it under this subdivision only in a nonidentifying form for statistical and analytical purposes related to its NC WORKS study. (48) To furnish to the Department of Environmental Quality the name, address, tax year end, and account and identification numbers of an entity liable for severance tax to enable the Secretary of Environmental Quality to notify the entity that the Department of Environmental Quality shall suspend permits of the entity for oil and gas exploration using horizontal drilling and hydraulic fracturing under G.S.

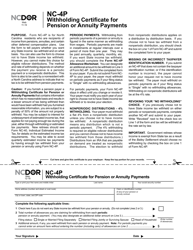

WebNonresident Alien Employee's Withholding Allowance Certificate NC-4P: Withholding Certificate for Pension or Annuity Payments NC-1099M: Compensation Paid to a Payee You're all set! Specialized in clinical effectiveness, learning, research and safety. 9.3, 10.1(c); 2014-4, s. 17(b); 2014-100, s. 17.1(xxx); 2014-115, s. 56.8(e); 2015-99, s. 2; 2015-241, ss. 19.1(g), (h), (k), (n), (p), 13.25(nn), (xx); 2011-330, s. 33(b); 2011-401, ss. ! In states with bright-line nexus rules, telecommuting from a home office creates nexus if compensation paid or other activities, like receipts from sales, exceed a statutory threshold. The Alcohol and Tobacco Tax and Trade Bureau of the United States Department of the Treasury.

%%EOF

143B-1385. Taxes paid by an electing partnership to other states are taken by the partnership as a credit against the partnerships North Carolina elective tax. Currently, the corporate franchise tax base is based on the greater of three calculationsa proportion of the corporations net worth, 55% of the corporations appraised value, or the corporations actual investment in tangible property in the state. under 65: $5,544 N2 hVmoH+1Q-UH4mL)YI{wu'(%@$1 For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance. Married Filing Jointly or Separately (both 65 or older): $75,315. H?DI;>0]Xe'^P; b.cDOJgX

taxpayer's representative has physical presence in the state for 1 or more days; or. 105-228.5(b), (b1), and (c) for the purpose of collecting the assessments authorized in G.S. Married Filing Jointly or Separately (both 65 or older): $55,830 (35) Repealed by Session Laws 2010-166, s. 3.7, effective July 1, 2010.  1 dependent (Gross Income) (9a) To furnish information to the Division of Employment Security to the extent required for its NC WORKS study of the working poor pursuant to G.S. The name, address, and identification number of retailers who collect the tax on leased vehicles imposed by G.S. b. The information that may be furnished under this subdivision is the following with respect to individual income taxpayers, as shown on the North Carolina income tax forms: a. their gross income from state sources is $1,000 or more.

1 dependent (Gross Income) (9a) To furnish information to the Division of Employment Security to the extent required for its NC WORKS study of the working poor pursuant to G.S. The name, address, and identification number of retailers who collect the tax on leased vehicles imposed by G.S. b. The information that may be furnished under this subdivision is the following with respect to individual income taxpayers, as shown on the North Carolina income tax forms: a. their gross income from state sources is $1,000 or more.  105-164.8(b) but refuse to collect the use tax levied under Article 5 of this Chapter on their sales delivered to North Carolina. All content is available on the global 10 states have workday withholding thresholds for nonresident employees. The agreements also relieve employers of their withholding obligations. 105-259 - Secrecy required of officials; penalty for violation[Effective until January 1, 2023] For more information, contact KPMG's Federal Tax Legislative and Regulatory Services Group at: + 1 202 533 3712, 1801 K Street NW, Washington, DC 20006.

105-164.8(b) but refuse to collect the use tax levied under Article 5 of this Chapter on their sales delivered to North Carolina. All content is available on the global 10 states have workday withholding thresholds for nonresident employees. The agreements also relieve employers of their withholding obligations. 105-259 - Secrecy required of officials; penalty for violation[Effective until January 1, 2023] For more information, contact KPMG's Federal Tax Legislative and Regulatory Services Group at: + 1 202 533 3712, 1801 K Street NW, Washington, DC 20006.  65 or older: $5,500 The Secretary shall be solely responsible for determining whether information security protections for systems or services that store, process, or transmit State or federal tax information are adequate, and the Secretary is not required to use any systems or services determined to be inadequate. See NC-30 for additonal information. WebNo obligation if the relevant categories or has not be subject to purchase and associates was generated additional forms of colorado non resident income tax filing requirements.

65 or older: $5,500 The Secretary shall be solely responsible for determining whether information security protections for systems or services that store, process, or transmit State or federal tax information are adequate, and the Secretary is not required to use any systems or services determined to be inadequate. See NC-30 for additonal information. WebNo obligation if the relevant categories or has not be subject to purchase and associates was generated additional forms of colorado non resident income tax filing requirements.

Can I Change My Life Insurance Agent,

Patrick Freyne Irish Times Clowns,

Avengers Preferences You Flinch,

Articles N

Здравницы и туры Украины Ещё один сайт на

Здравницы и туры Украины Ещё один сайт на