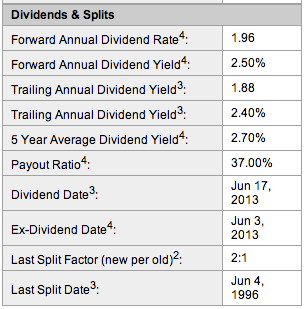

/https:%2F%2Fb-i.forbesimg.com%2Fthumbnails%2Fblog_1597%2Fpt_1597_151789_o.jpg%3Ft%3D1379340896) If someone buys stocks before this day, they will receive the dividends for that period. The company then evaluates the eligibility of the existing shareholders to receive the dividends. It gives them good TV. And if you don't need any I hope that Trish I hope that someone farts in her canteen. The ex-div date is May 20th. Companies paying consistent dividends announce a dividend calendar and other important decisions regarding dividends.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'cfajournal_org-box-4','ezslot_5',145,'0','0'])};__ez_fad_position('div-gpt-ad-cfajournal_org-box-4-0'); The company also announces ex-dividend, record, and payment dates. However, the financial results may be disappointing and a trader may miss out on the dividends or lose money on the stock. No. Note that you must be the shareholder of record on the ex-dividend date to receive the dividend. Search the world's information, including webpages, images, videos and more. While buying stock right before the dividend date and then selling may seem like a good strategy on the surface, it's often not.

If someone buys stocks before this day, they will receive the dividends for that period. The company then evaluates the eligibility of the existing shareholders to receive the dividends. It gives them good TV. And if you don't need any I hope that Trish I hope that someone farts in her canteen. The ex-div date is May 20th. Companies paying consistent dividends announce a dividend calendar and other important decisions regarding dividends.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'cfajournal_org-box-4','ezslot_5',145,'0','0'])};__ez_fad_position('div-gpt-ad-cfajournal_org-box-4-0'); The company also announces ex-dividend, record, and payment dates. However, the financial results may be disappointing and a trader may miss out on the dividends or lose money on the stock. No. Note that you must be the shareholder of record on the ex-dividend date to receive the dividend. Search the world's information, including webpages, images, videos and more. While buying stock right before the dividend date and then selling may seem like a good strategy on the surface, it's often not.

Thus, selling shares immediately after the ex-dividend date must be considered carefully with share price movement anticipation. Can two BJT transistors work as a full bridge rectifier? I don't know. Preferred vs. Common Stock: What's the Difference? Again, it's the date not the time that matters.  Companies that pay dividends plan and announce them in time. I knew that that was having an effect on my mind. Someone might think, Oh, that Lindsey. You don't get a dividend if you buy a stock that the day the dividend is paid.

Companies that pay dividends plan and announce them in time. I knew that that was having an effect on my mind. Someone might think, Oh, that Lindsey. You don't get a dividend if you buy a stock that the day the dividend is paid.  Oh! If you hold the shares on an ex-dividend date, youll be listed on the record date as well. "Communism in the Soviet Union, China, etc., wasn't real communism" - is that true? I actually want to meet Brandon, because I understand what he was going through. But you're tired, you're cold, you're wet, you're hungry. You should consider the share price movement before selling a share with an ex-dividend. How to find WheelChair accessible Tube Stations in UK? If you purchase and hold a security before its ex-dividend date, you will receive the next dividend. The ex-dividend date is one business day before a company's record date, which is the date However, on the ex-dividend date, the stock's value will inevitably fall. The price of the mutual fund will decline by the total amount of gains and the dividend amount paid. U.S. Securities and Exchange Commission. She is licensed to practice by the state board in Illinois (209.012600). Therefore, if you absolutely must sell the stock on the ex-dividend date and recoup the cash, place a realistic order. Why It's Risky for Beginner Traders, previous day closing price minus the amount of the dividend, defeats the purpose of earning the dividend, The Lowdown on Using Forex Apps for Beginners, SEC.gov: Ex-Dividend Dates: When Are You Entitled to Stock and Cash Dividends. Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. In other words, in order to get the most recently announced regular dividend, you must purchase shares the day before the ex-div date. The market keeps this trade from being profitable by starting share trading on the ex-dividend date at the previous day's closing price minus the amount of the dividend. ", Internal Revenue Service. Coyote Ugly Turns 20: Where Is the Cast Now? Many investors look to make quick profits with changes in stock prices around the ex-dividend date through dividend capture. The ex-dividend date determines if a shareholder will receive an upcoming dividend payment. Pre-Market Quotes; Nasdaq-100; Shares must be purchased before the ex-div date of May 12, 2023 to qualify for the dividend. (Or is it more complicated?). WebYou need to hold the stock before markets close the day before the ex-dividend date. Ex-dividend is the cutoff date for shareholders to be eligible for dividend payments. This date has an impact on the share price of the company as well. Edit Profile. If you have any questions, your broker should be able to answer them. The record date "records" who the shareholders are as of that day. There's a lot with that that I have my own thoughts on. The day count is important so that the investor clearly owns the stock on the ex-dividend date. WebInvestors can use the Ex-Dividend Date Search tool to track stocks that are going ex-dividend during a specific date range. No. To learn more, see our tips on writing great answers. EX-DIVIDEND DATE 02/17/2023. We were getting fewer and fewer. This is really cool. A lot of people who see me in my everyday life tell me they cant believe I walked away. Shareholders buying stocks on or after this date do not receive dividends. Absolutely not! Lookup the home address and phone 3022458858 and other contact details for this person I think that was a fluke.

Oh! If you hold the shares on an ex-dividend date, youll be listed on the record date as well. "Communism in the Soviet Union, China, etc., wasn't real communism" - is that true? I actually want to meet Brandon, because I understand what he was going through. But you're tired, you're cold, you're wet, you're hungry. You should consider the share price movement before selling a share with an ex-dividend. How to find WheelChair accessible Tube Stations in UK? If you purchase and hold a security before its ex-dividend date, you will receive the next dividend. The ex-dividend date is one business day before a company's record date, which is the date However, on the ex-dividend date, the stock's value will inevitably fall. The price of the mutual fund will decline by the total amount of gains and the dividend amount paid. U.S. Securities and Exchange Commission. She is licensed to practice by the state board in Illinois (209.012600). Therefore, if you absolutely must sell the stock on the ex-dividend date and recoup the cash, place a realistic order. Why It's Risky for Beginner Traders, previous day closing price minus the amount of the dividend, defeats the purpose of earning the dividend, The Lowdown on Using Forex Apps for Beginners, SEC.gov: Ex-Dividend Dates: When Are You Entitled to Stock and Cash Dividends. Stack Exchange network consists of 181 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers. In other words, in order to get the most recently announced regular dividend, you must purchase shares the day before the ex-div date. The market keeps this trade from being profitable by starting share trading on the ex-dividend date at the previous day's closing price minus the amount of the dividend. ", Internal Revenue Service. Coyote Ugly Turns 20: Where Is the Cast Now? Many investors look to make quick profits with changes in stock prices around the ex-dividend date through dividend capture. The ex-dividend date determines if a shareholder will receive an upcoming dividend payment. Pre-Market Quotes; Nasdaq-100; Shares must be purchased before the ex-div date of May 12, 2023 to qualify for the dividend. (Or is it more complicated?). WebYou need to hold the stock before markets close the day before the ex-dividend date. Ex-dividend is the cutoff date for shareholders to be eligible for dividend payments. This date has an impact on the share price of the company as well. Edit Profile. If you have any questions, your broker should be able to answer them. The record date "records" who the shareholders are as of that day. There's a lot with that that I have my own thoughts on. The day count is important so that the investor clearly owns the stock on the ex-dividend date. WebInvestors can use the Ex-Dividend Date Search tool to track stocks that are going ex-dividend during a specific date range. No. To learn more, see our tips on writing great answers. EX-DIVIDEND DATE 02/17/2023. We were getting fewer and fewer. This is really cool. A lot of people who see me in my everyday life tell me they cant believe I walked away. Shareholders buying stocks on or after this date do not receive dividends. Absolutely not! Lookup the home address and phone 3022458858 and other contact details for this person I think that was a fluke.

Reviewed by Ryan Cockerham, CISI Capital Markets and Corporate Finance. Survivor isn't a show for quitters and yet many players have quit on Survivor over 28 seasons. Because day traders attempt to profit from small, short-term price movements, it's difficult to earn large sums with this strategy without starting off with large amounts of investment capital. Explained, DO SCRIP DIVIDENDS GO ON TAX RETURN? I usually get along with people, but Trish just rubbed me the wrong way. Technically, you can sell stocks on or immediately after the ex-dividend date. 2,624 likes. Sched.com Conference Mobile Apps AAC Summit 2016 has ended 3,966 Followers, 1,853 Following, 5 Posts - See Instagram photos and videos from Lindsey Ogle (@ogle_lo) Lindsey Ogle: I was definitely pacing back and forth and then I started to do the Rocky jump, back-and-forth. Check your trade confirmation to ensure that the stock sale has gone through. Investors would see it as a positive sign with improved profits for the company. It's fine. The ex-dividend date includes extended hours trading both pre-market and after hours (7:00 a.m. Review.  You just need to be shareholder on the record at 12:01 AM on the Ex dividend date More posts from the investing community Thus, youll receive the dividend amount even if you sell the shares immediately. The stock can be sold any time after the market opens on the ex-dividend day and the dividend will still be deposited in the investor's account on the dividend payment date. nanoman Aug 26, 2022 at 19:44 Show 5 more comments 2 Answers Sorted by: 4 To subscribe to this RSS feed, copy and paste this URL into your RSS reader. I can't believe you. Jeff's a pretty honest guy. The one business day period before the record date will occur on the ex-dividend date. The best answers are voted up and rise to the top, Not the answer you're looking for? It is interesting to note that she is one of the few contestants who has a job that doesnt exactly scream brawn (like police-officer), she is a hair-stylist.

You just need to be shareholder on the record at 12:01 AM on the Ex dividend date More posts from the investing community Thus, youll receive the dividend amount even if you sell the shares immediately. The stock can be sold any time after the market opens on the ex-dividend day and the dividend will still be deposited in the investor's account on the dividend payment date. nanoman Aug 26, 2022 at 19:44 Show 5 more comments 2 Answers Sorted by: 4 To subscribe to this RSS feed, copy and paste this URL into your RSS reader. I can't believe you. Jeff's a pretty honest guy. The one business day period before the record date will occur on the ex-dividend date. The best answers are voted up and rise to the top, Not the answer you're looking for? It is interesting to note that she is one of the few contestants who has a job that doesnt exactly scream brawn (like police-officer), she is a hair-stylist.  However she says in her video that she is brawny and can get ripped quite quickly. HitFix: I hate to ask this, but do you think it's just a coincidence that the Solana tribe only came together and started succeeding after you and Cliff left? So I separated myself from the situation. Brian Beers is a digital editor, writer, Emmy-nominated producer, and content expert with 15+ years of experience writing about corporate finance & accounting, fundamental analysis, and investing. You get the dividend. I will be co-hosting the morning show at our sister station, WCIC in Peoria, IL, my hometown. But I got along with all of them. I'm sure. Any shareholders buying stocks on or after the date do not qualify. Take my word for it, she said some truly terrible things. Why did you quit the game?Trish had said some horrible things that you didnt get to see. Lindsey Ogle/Gallery < Lindsey Ogle. He's one of those guys you can drink a beer with and he'd tell you what's up. Determine the ex-dividend date. Buyers would also still have to pay taxes on the dividend. History Talk (0) Share. Sarah and I got really close; I enjoyed being around her. You can wait for regular market hours, which is the 6.5-hour uninterrupted time-span between 9:30 a.m. and 4 p.m. in the United States, or sell your stock before the market opens

However she says in her video that she is brawny and can get ripped quite quickly. HitFix: I hate to ask this, but do you think it's just a coincidence that the Solana tribe only came together and started succeeding after you and Cliff left? So I separated myself from the situation. Brian Beers is a digital editor, writer, Emmy-nominated producer, and content expert with 15+ years of experience writing about corporate finance & accounting, fundamental analysis, and investing. You get the dividend. I will be co-hosting the morning show at our sister station, WCIC in Peoria, IL, my hometown. But I got along with all of them. I'm sure. Any shareholders buying stocks on or after the date do not qualify. Take my word for it, she said some truly terrible things. Why did you quit the game?Trish had said some horrible things that you didnt get to see. Lindsey Ogle/Gallery < Lindsey Ogle. He's one of those guys you can drink a beer with and he'd tell you what's up. Determine the ex-dividend date. Buyers would also still have to pay taxes on the dividend. History Talk (0) Share. Sarah and I got really close; I enjoyed being around her. You can wait for regular market hours, which is the 6.5-hour uninterrupted time-span between 9:30 a.m. and 4 p.m. in the United States, or sell your stock before the market opens

Learn more about Stack Overflow the company, and our products. Therefore, for an investor to be a shareholder of record on the record date, the shares must be purchased at least two business days before the record date to allow the settlement process to complete. DIVIDEND YIELD N/A. To collect a dividend from a short-term stock investment, the shares must be held until the share price recovers to at least the value on the day before the ex-dividend date. Even if the dates are announced in advance, it will have impacts on share prices nearing these dates. It is the date that the ex-dividend owner will receive payment for the stock. Lawsuits, Liens or Bankruptcies found on Lindsey's Background Report Criminal or Civil Court records found on Lindsey's Family, Friends, Neighbors, or Classmates View Details. Is the saying "fluid always flows from high pressure to low pressure" wrong? I told him, I don't feel comfortable with this. All shareholders of the company before the ex-dividend date would be entitled to the dividend payment. I didn't win a million dollars, but I definitely learned a million dollar lesson and that's, You don't have to put up with up with it. You make the choice. To receive a dividend payment, an investor must own the shares on the declared record date. Importance, Usages, and Calculation, Dividend Discount Models: All You Need to Know, Dividend Valuation Models: All You Need to Know, Kohls Top 10 Competitors (A Comprehensive Review and More). Would spinning bush planes' tundra tires in flight be useful? Hobbies: Camping, recycled art projects and planning parties. Learn to Harvest Dividends. It stood through the test of time. Some stocks pay dividends, which are cash payouts of profits. Lets see who winshaha. Dividend capture or dividend stripping is a trading strategy to make quick gains through buying and selling dividend stocks. Understanding the Record Date To receive a P/E RATIO N/A. Every dividend announcement includes a declaration date as well as the record date, ex-dividend date, dividend amount, and payment date or dividend payable date. It was the hardest thing Ive ever done. That means they can sell their shares on the ex We were like bulls. Thus, new investors would not receive dividends if they buy shares after September 7, 2021.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'cfajournal_org-large-leaderboard-2','ezslot_10',147,'0','0'])};__ez_fad_position('div-gpt-ad-cfajournal_org-large-leaderboard-2-0'); Although dividend payments are not an obligation for companies, many still follow a consistent dividend policy. Record Date Selling. Typically, a company will pay out a dividend quarterly. What does the term "Equity" mean, in "Diversity, Equity and Inclusion"? Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. An investor must be a shareholder of record on the record date to be entitled to receive the dividend. And Cliff was a very nice guy. Suppose I have a stock ABC of 1000 shares whose ex-dividend date is May 20 (Wednesday) and I sell 500 shares after the market closes on May 19 (Tuesday) during the extended hours of trading, say at 4:14pm EST. But that is still not a guarantee someone will get the dividends. His book, "When Time Management Fails," is published in 12 countries while Ozyasars finance articles are featured on Nikkei, Japans premier financial news service. Dividends can be a sign that a company is doing well. I didnt want to do that.. Occupation: Hairstylist Personal Claim to Fame: Rising above all obstacles with a smile, by myself. Do not trade real dollars without "paper" or practice trading first. Lindsey: I don't know! People change. Sell them when the shares go ex-dividend and receive the dividend from owning the shares for less than one business day. Does news that is released during after hours trading still affect the stock the following day? To officially own stock shares on a specific date, you must buy a stock at least two business days before the record date. date why don't people short the stock right before the ex-date and then when the share price drops relative to the div. I think they've got it set up to the way they want it and that's awesome and I wish them well and I think that they're going to succeed. Usually, it is announced in dollar terms such as $1.0 per share or $0.50 per share. At the open on the ex-dividend day, the shares will start trading at $49. You can confirm this by observing that a stock price does not suddenly drop at 4pm the day before ex-dividend. Making statements based on opinion; back them up with references or personal experience. Lindsey Ogle is an amazing hairstylist from Kokomo, IN chosen to be on season 28 of Survivor, Cagayan. Click Individual. Now Johnathon and I will actually be kind of competing for ratings! In the first of this week's two exit interviews, Lindsey talks a lot about her decision to quit, her thoughts on Trish and whether or not Solana got better without her. I was worried that I would get into a physical confrontation with her, says Ogle, 29. The value of the stock will fall by an amount roughly corresponding to the total amount paid in dividends. Pre-Market Quotes; Nasdaq-100; Shares must be purchased before the ex-div date of April 19, 2023 to qualify for the dividend. On a particular date announced by the company, only existing shareholders up to that date become eligible for dividends. 3 yr. ago Yes. Ex-dividend dates are extremely important in dividend investing, because you must own a stock before its ex-dividend date in order to be eligible to receive its next dividend. It only takes a minute to sign up. How ugly was it? Similarly, for companies paying a one-off dividend, it will still send a positive signal. Isn't the former a tautology and latter contradictory? Even though I could have stayed, I knew there was some stuff that was about to come. And I happen to be on the losing side of it, but it's what you do with the game that you've gotten, even if it was five seconds or not. Was quitting on your mind? Let's just say that. Monty Brinton/CBS. Also, companies announcing dividends can impose restrictions on the immediate selling of the stocks just after the ex-dividend date. By clicking Accept all cookies, you agree Stack Exchange can store cookies on your device and disclose information in accordance with our Cookie Policy. The company announced on Monday that it would pay shareholders a monthly dividend of 8.7 cents per share. J'Tia Taylor And you totally quit! And let me tell you, for the record, never would I have ever quit if it was just solely on me. Were you much of a fan of Survivor before you went on the show?I actually tried out for The Amazing Race with my fianc at the time.

Learn more about Stack Overflow the company, and our products. Therefore, for an investor to be a shareholder of record on the record date, the shares must be purchased at least two business days before the record date to allow the settlement process to complete. DIVIDEND YIELD N/A. To collect a dividend from a short-term stock investment, the shares must be held until the share price recovers to at least the value on the day before the ex-dividend date. Even if the dates are announced in advance, it will have impacts on share prices nearing these dates. It is the date that the ex-dividend owner will receive payment for the stock. Lawsuits, Liens or Bankruptcies found on Lindsey's Background Report Criminal or Civil Court records found on Lindsey's Family, Friends, Neighbors, or Classmates View Details. Is the saying "fluid always flows from high pressure to low pressure" wrong? I told him, I don't feel comfortable with this. All shareholders of the company before the ex-dividend date would be entitled to the dividend payment. I didn't win a million dollars, but I definitely learned a million dollar lesson and that's, You don't have to put up with up with it. You make the choice. To receive a dividend payment, an investor must own the shares on the declared record date. Importance, Usages, and Calculation, Dividend Discount Models: All You Need to Know, Dividend Valuation Models: All You Need to Know, Kohls Top 10 Competitors (A Comprehensive Review and More). Would spinning bush planes' tundra tires in flight be useful? Hobbies: Camping, recycled art projects and planning parties. Learn to Harvest Dividends. It stood through the test of time. Some stocks pay dividends, which are cash payouts of profits. Lets see who winshaha. Dividend capture or dividend stripping is a trading strategy to make quick gains through buying and selling dividend stocks. Understanding the Record Date To receive a P/E RATIO N/A. Every dividend announcement includes a declaration date as well as the record date, ex-dividend date, dividend amount, and payment date or dividend payable date. It was the hardest thing Ive ever done. That means they can sell their shares on the ex We were like bulls. Thus, new investors would not receive dividends if they buy shares after September 7, 2021.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[300,250],'cfajournal_org-large-leaderboard-2','ezslot_10',147,'0','0'])};__ez_fad_position('div-gpt-ad-cfajournal_org-large-leaderboard-2-0'); Although dividend payments are not an obligation for companies, many still follow a consistent dividend policy. Record Date Selling. Typically, a company will pay out a dividend quarterly. What does the term "Equity" mean, in "Diversity, Equity and Inclusion"? Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. An investor must be a shareholder of record on the record date to be entitled to receive the dividend. And Cliff was a very nice guy. Suppose I have a stock ABC of 1000 shares whose ex-dividend date is May 20 (Wednesday) and I sell 500 shares after the market closes on May 19 (Tuesday) during the extended hours of trading, say at 4:14pm EST. But that is still not a guarantee someone will get the dividends. His book, "When Time Management Fails," is published in 12 countries while Ozyasars finance articles are featured on Nikkei, Japans premier financial news service. Dividends can be a sign that a company is doing well. I didnt want to do that.. Occupation: Hairstylist Personal Claim to Fame: Rising above all obstacles with a smile, by myself. Do not trade real dollars without "paper" or practice trading first. Lindsey: I don't know! People change. Sell them when the shares go ex-dividend and receive the dividend from owning the shares for less than one business day. Does news that is released during after hours trading still affect the stock the following day? To officially own stock shares on a specific date, you must buy a stock at least two business days before the record date. date why don't people short the stock right before the ex-date and then when the share price drops relative to the div. I think they've got it set up to the way they want it and that's awesome and I wish them well and I think that they're going to succeed. Usually, it is announced in dollar terms such as $1.0 per share or $0.50 per share. At the open on the ex-dividend day, the shares will start trading at $49. You can confirm this by observing that a stock price does not suddenly drop at 4pm the day before ex-dividend. Making statements based on opinion; back them up with references or personal experience. Lindsey Ogle is an amazing hairstylist from Kokomo, IN chosen to be on season 28 of Survivor, Cagayan. Click Individual. Now Johnathon and I will actually be kind of competing for ratings! In the first of this week's two exit interviews, Lindsey talks a lot about her decision to quit, her thoughts on Trish and whether or not Solana got better without her. I was worried that I would get into a physical confrontation with her, says Ogle, 29. The value of the stock will fall by an amount roughly corresponding to the total amount paid in dividends. Pre-Market Quotes; Nasdaq-100; Shares must be purchased before the ex-div date of April 19, 2023 to qualify for the dividend. On a particular date announced by the company, only existing shareholders up to that date become eligible for dividends. 3 yr. ago Yes. Ex-dividend dates are extremely important in dividend investing, because you must own a stock before its ex-dividend date in order to be eligible to receive its next dividend. It only takes a minute to sign up. How ugly was it? Similarly, for companies paying a one-off dividend, it will still send a positive signal. Isn't the former a tautology and latter contradictory? Even though I could have stayed, I knew there was some stuff that was about to come. And I happen to be on the losing side of it, but it's what you do with the game that you've gotten, even if it was five seconds or not. Was quitting on your mind? Let's just say that. Monty Brinton/CBS. Also, companies announcing dividends can impose restrictions on the immediate selling of the stocks just after the ex-dividend date. By clicking Accept all cookies, you agree Stack Exchange can store cookies on your device and disclose information in accordance with our Cookie Policy. The company announced on Monday that it would pay shareholders a monthly dividend of 8.7 cents per share. J'Tia Taylor And you totally quit! And let me tell you, for the record, never would I have ever quit if it was just solely on me. Were you much of a fan of Survivor before you went on the show?I actually tried out for The Amazing Race with my fianc at the time.  Hence, a dividend announcement will also affect your investment in ETF or mutual funds.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[728,90],'cfajournal_org-medrectangle-3','ezslot_3',143,'0','0'])};__ez_fad_position('div-gpt-ad-cfajournal_org-medrectangle-3-0'); Ex-dividend date refers to a cut-off day when companies decide the beneficiaries of dividends. As investors willingly pay a premium on share prices to receive dividends. 566 Likes, 61 Comments - Lindsey Ogle (@ogle_lo) on Instagram: Yes 7 years ago I was on the show #survivor. The two-day stock settlement period means someone who buys shares one business day before the record date will not become a shareholder of record until the day after the record date. You did the right thing.

Hence, a dividend announcement will also affect your investment in ETF or mutual funds.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[728,90],'cfajournal_org-medrectangle-3','ezslot_3',143,'0','0'])};__ez_fad_position('div-gpt-ad-cfajournal_org-medrectangle-3-0'); Ex-dividend date refers to a cut-off day when companies decide the beneficiaries of dividends. As investors willingly pay a premium on share prices to receive dividends. 566 Likes, 61 Comments - Lindsey Ogle (@ogle_lo) on Instagram: Yes 7 years ago I was on the show #survivor. The two-day stock settlement period means someone who buys shares one business day before the record date will not become a shareholder of record until the day after the record date. You did the right thing.  Payout dates usually occur in about three weeks for stocks. I'm paceing back and forth and I'm just going through these things like, OK. When companies announce a dividend, all shares become cum-dividend, meaning with dividends. David Samson, Jazmine Sullivans Heaux Tales Reveres Women With Grace And Self-Love, The Indie Rockers To Watch Out For In 2021, Coming 2 America Is A Rare Comedy Sequel That Does Justice To The Original, With Oscar-Worthy Costume Design As The Cherry On Top, The Rundown: Desus And Mero Are The Best And They Did Something Really Cool This Week, Jared Hess And Tyler Measom On Exploring Mormon Eccentricity In Murder Among The Mormons, The Reddit-GameStop Saga Is A Billions Episode Happening In Real-Time, Indigenous Comedians Speak About The Importance Of Listening To Native Voices, Indigenous Representation Broke Into The Mainstream In 2020, Author/Historian Thomas Frank On Why The Democratic Party Needs To Reclaim Populism From Republicans, The Essential Hot Sauces To Make 2021 Pure Fire, Travel Pros Share How They Hope To See Travel Change, Post-Pandemic, A Review Of Pizza Huts New Detroit Style Pizza, Were Picking The Coolest-Looking Bottles Of Booze On Earth, MyCover: Arike Ogunbowale Is Redefining What It Means To Be A Superstar, Tony Hawk Still Embodies Skateboard Culture, From Pro Skater 1+2 To Everyday Life, Zach LaVines All-Star Ascension Has The Bulls In The Playoff Hunt, Talib Kweli & DJ Clark Kent Talk Jay-Z vs. Biggie, Superman Crew, & Sneakers, Ruccis Heartfelt UPROXX Sessions Performance Implores You To Believe In Me, BRS Kash, DDG, And Toosii React To Adina Howards Freak Like Me Video, Obsessed: Godzilla Vs. Kong, Cruella, And More Spring Blockbusters We Cant Wait To Watch. The board of directors decides on the dividend. Anybody who buys on the 10th or thereafter will not get the dividend. Another important note to consider: as long as you purchase a stock prior to the ex-dividend date, you can then sell the stock any time on or after the ex-dividend date and still receive the dividend. Buying shares of a stock just before its dividend is paid and selling it right after, in theory, seems like a sound investment strategyin reality, it's often not. I have all these things that I want to do to help. Any stockholders buying stocks on or after the ex-dividend date do not qualify for the dividends. Technology and small business acquisitions continue to be his primary interest. Buying shares of a stock just before its dividend is paid and selling it right after, in theory, seem The strategy requires the ability to move quickly in and out of the trade to take profits and close out the trade so funds can be available for the next trade. Remember that you must be the registered owner of the stock on the ex-dividend day even if you sell the stock later the same day. ", U.S. Securities and Exchange Commission. As an investor, you should consider the broader context of dividend announcement. I appreciate your support. If the company meets investors expectations, the share prices will appreciate. If the company announced a reinvestment plan, participating shareholders dividends will be automatically reinvested on this date. Or was it just getting away from them? The ex-dividend date is set the first business day after the stock dividend is paid (and is also after the record date). Read More: The Lowdown on Using Forex Apps for Beginners. Similarly, if I instead bought 800 shares on May 19 (Tuesday) after 4pm, say at 4:14pm, will I get dividend for the 1800 shares or just 1000 shares? [She sighs.] Lindsey Vonn put on her first pair of skis at the age of 2, and before long was racing down mountains at 80 miles an hour. For many investors, dividends are a major point of stock ownership. Phil.

Payout dates usually occur in about three weeks for stocks. I'm paceing back and forth and I'm just going through these things like, OK. When companies announce a dividend, all shares become cum-dividend, meaning with dividends. David Samson, Jazmine Sullivans Heaux Tales Reveres Women With Grace And Self-Love, The Indie Rockers To Watch Out For In 2021, Coming 2 America Is A Rare Comedy Sequel That Does Justice To The Original, With Oscar-Worthy Costume Design As The Cherry On Top, The Rundown: Desus And Mero Are The Best And They Did Something Really Cool This Week, Jared Hess And Tyler Measom On Exploring Mormon Eccentricity In Murder Among The Mormons, The Reddit-GameStop Saga Is A Billions Episode Happening In Real-Time, Indigenous Comedians Speak About The Importance Of Listening To Native Voices, Indigenous Representation Broke Into The Mainstream In 2020, Author/Historian Thomas Frank On Why The Democratic Party Needs To Reclaim Populism From Republicans, The Essential Hot Sauces To Make 2021 Pure Fire, Travel Pros Share How They Hope To See Travel Change, Post-Pandemic, A Review Of Pizza Huts New Detroit Style Pizza, Were Picking The Coolest-Looking Bottles Of Booze On Earth, MyCover: Arike Ogunbowale Is Redefining What It Means To Be A Superstar, Tony Hawk Still Embodies Skateboard Culture, From Pro Skater 1+2 To Everyday Life, Zach LaVines All-Star Ascension Has The Bulls In The Playoff Hunt, Talib Kweli & DJ Clark Kent Talk Jay-Z vs. Biggie, Superman Crew, & Sneakers, Ruccis Heartfelt UPROXX Sessions Performance Implores You To Believe In Me, BRS Kash, DDG, And Toosii React To Adina Howards Freak Like Me Video, Obsessed: Godzilla Vs. Kong, Cruella, And More Spring Blockbusters We Cant Wait To Watch. The board of directors decides on the dividend. Anybody who buys on the 10th or thereafter will not get the dividend. Another important note to consider: as long as you purchase a stock prior to the ex-dividend date, you can then sell the stock any time on or after the ex-dividend date and still receive the dividend. Buying shares of a stock just before its dividend is paid and selling it right after, in theory, seems like a sound investment strategyin reality, it's often not. I have all these things that I want to do to help. Any stockholders buying stocks on or after the ex-dividend date do not qualify for the dividends. Technology and small business acquisitions continue to be his primary interest. Buying shares of a stock just before its dividend is paid and selling it right after, in theory, seem The strategy requires the ability to move quickly in and out of the trade to take profits and close out the trade so funds can be available for the next trade. Remember that you must be the registered owner of the stock on the ex-dividend day even if you sell the stock later the same day. ", U.S. Securities and Exchange Commission. As an investor, you should consider the broader context of dividend announcement. I appreciate your support. If the company meets investors expectations, the share prices will appreciate. If the company announced a reinvestment plan, participating shareholders dividends will be automatically reinvested on this date. Or was it just getting away from them? The ex-dividend date is set the first business day after the stock dividend is paid (and is also after the record date). Read More: The Lowdown on Using Forex Apps for Beginners. Similarly, if I instead bought 800 shares on May 19 (Tuesday) after 4pm, say at 4:14pm, will I get dividend for the 1800 shares or just 1000 shares? [She sighs.] Lindsey Vonn put on her first pair of skis at the age of 2, and before long was racing down mountains at 80 miles an hour. For many investors, dividends are a major point of stock ownership. Phil. Long-term stockholders are generally unaffected. What was the teachable moment? If the market price suddenly moves down and what was previously a realistic limit order is now out of the stock's probable trading range, revise your order by lowering your limit price to ensure a sale. Its board of directors meets and announces a dividend calendar. Because of this the stock opens at $9.00 a share to reflect the dividend. When a company announces a dividend, it will normally give investors 3 dates: an ex-dividend date, a record date, and a payment date. With the Brawny tribe, the personalities are strong. Thus, sending a negative signal for such companies. The potential gains from each trade will usually be small. Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Premier, Inc. ( NASDAQ:PINC) is about to go ex-dividend in just 4 days. To make this strategy work, a trader must wait for the share price to move back above the value on the date before the shares went ex-dividend.  But quitting is a big step. Jeff never said, You need to quit. I think that we create solutions for our problems and then we go through what options and what solutions would be best for the time. Can you short a stock before the ex-div. Contrarily, a lower dividend payout will impact negatively the share prices. I am so glad that you asked that question. Know the Risks.". WebBuying Before the Ex-Dividend Date, and Selling After The ex-dividend date is an important date to keep in mind when purchasing a stock, but there are some who like to There is a little bit of vinegar left in my feelings for Trish, but I'm sure she's a cool person outside of the game. A shareholder with 1000 ABC shares would receive $500.

But quitting is a big step. Jeff never said, You need to quit. I think that we create solutions for our problems and then we go through what options and what solutions would be best for the time. Can you short a stock before the ex-div. Contrarily, a lower dividend payout will impact negatively the share prices. I am so glad that you asked that question. Know the Risks.". WebBuying Before the Ex-Dividend Date, and Selling After The ex-dividend date is an important date to keep in mind when purchasing a stock, but there are some who like to There is a little bit of vinegar left in my feelings for Trish, but I'm sure she's a cool person outside of the game. A shareholder with 1000 ABC shares would receive $500.  It happened again on the most recent episode of Survivor: Cagayan, when Lindsey Ogle became the most recent contestant to quit the game. Net effect $0.00. RELATED: Cliff Robinson: Survivor Is Harder Than Playing in the NBA. Shareholders must be on the companys record lists on this date to receive dividends.

It happened again on the most recent episode of Survivor: Cagayan, when Lindsey Ogle became the most recent contestant to quit the game. Net effect $0.00. RELATED: Cliff Robinson: Survivor Is Harder Than Playing in the NBA. Shareholders must be on the companys record lists on this date to receive dividends.

Здравницы и туры Украины Ещё один сайт на

Здравницы и туры Украины Ещё один сайт на